Head and Shoulders Pattern 2024 At the very start of the topic,one can see that this discussion is going to about What is a head and shoulders pattern? Without wasting time let’s start this article’s discussion.

This pattern is related to chart formation that can be appeared in a baseline of head and shoulders through three peaks. This appearance of formation first has high height and later it goes toward to highest point.

This is a technical analysis part of this particular head and shoulders pattern to build specification information or informative prediction. This prediction is also related to this pattern but this time it is included in a bearish and bullish trend.

Head and Shoulders Pattern (PDF) Rules 2024

Trend reversals havesome reliable patterns that are located in the head and shoulders at top pattern signals. This pattern degrees have some varying of currencies to make it more clear and upward trend.

After knowing what is a head and shoulders pattern now discussion turns around what does a head and shoulders pattern tell you?

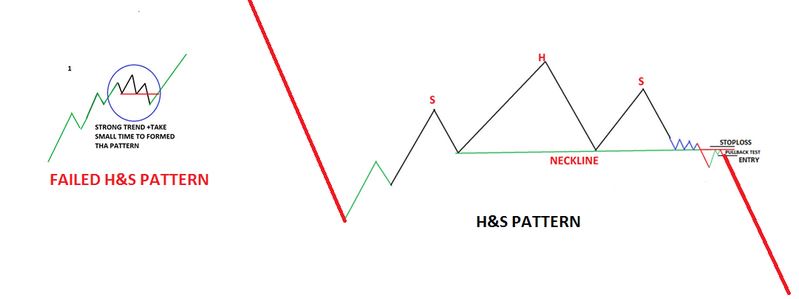

In the previous discussion,one can see what is ahead and shoulders pattern and now the discussion is about what this pattern tells you. This pattern is converted into three parts that are related to bearish and bullish, price rises,and first,peek.

As one can see bearish and bullish take price range into a high level and price range go into the highest point but decline.

After it,the price range also rises like a sun but this timeto declines again.

This time too price rises again but this is the last time of rising before declining.

These peak times are related to each other and this clearly shows some relation between head and shoulders to this points. The first one and the third one are called shoulders and the second one is called head that too relates to the price rise and the highest point of this is called the neckline of this pattern.

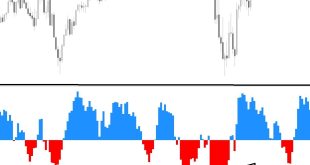

Best Head and Shoulders Indicator pattern MT4

This indicator pattern is also trend upward and downward to show signals of reverse and inverse pattern of head and shoulders.

This is one is the most reliable indicators that show every signal which take stock price up and down too by separating temporary lines. First and third lines are showing bearish and bullish trend and second one is showing lowest part of this reverse price to keep it rallying upward.

Understanding part of a head and shoulders pattern:

There are very few important indicators that are good and form in a better way. In that indicators head and shoulders pattern are good for giving them shape of stock market’s upward and downward.

This pattern subsequently rises in the peak side and then going toward decline part of this move. It has two bases one is called nose and other is original case which is going toward peak side. Chart line of this neckline is going toward its peak of formation and then goes towards decline in terms like always.

This is unstoppable part of particular patterns that can be seen in head and shoulders pattern.

How to trade head and shoulders pattern?

Traders need to show their patience while completing this pattern because it takes some time. This may be not completed in time nor develop that is the biggest problem or not developing in the future.

Traders are not break any neckline of this pattern because of seeing some other trading that are coming to an end of the completing. Traders are highly waited for the end of this neckline to the head and then move it to the lowest part to the highest part of the shoulder.

After shoulder’s formation trader can not wait and move price action chart in the complete section. Traders are planning some parts to make it more clear and change their target to not take it toward down side but move it toward stop loss system and then it goes toward profit targets side.

After this traders are waiting to their breakout entries which is the most awaited entry happens.

This entry break the neckline of head and shoulders pattern for trading this pattern. Because of trader’s move another trading point occur in this and while having patience traders are completely move their point with positivity. This also comes with pullback that is become the reason of neckline break.

Inverse Head and Shoulders Bottom Pattern

But after this all process pullback stops the whole process and breakout resuming the circle of trading. This has two types of moving parts one is missed to keep price action trade and other is breakout to give it direction.

Placing your stops:

In this pattern stopping has a place to take it above side of the shoulder and this pattern has topping after the neckline. The head of the pattern is mostly use for stop system and shoulder is taking some risk to reward this pattern.

This is called inverse and reverse system which both head and shoulders playing their part. Traders can easily see that head and shoulders both placed two different parts and levels one is stopping part and second is taking risk and explore.

Setting your profit targets:

The other part of this particular strategic has profit targets for this pattern to show different types of values and practices. The difference between head and shoulders make some other low and highest points between them.

One is related to stop and other is taking risk. This neckline breakout provide them a new price range target which can not be gone down side. But head is moving differently and shoulder is trying to take it on the profit side and taking the target in upside. The breakout moving on the neckline side to take it on up and profit side which is target.

Both head and shoulders are the different trend and breakout which are doing their best. This case of breakout working on profit to complete its target with long term strategy. It takes some time to fulfill the target of breakout to getting profit of up side.

Forex MT4/MT5 Indicators Forex Indicators Download Free

Forex MT4/MT5 Indicators Forex Indicators Download Free